By supporting the KidWorks community, you empower first-generation college students on their educational journey toward meaningful careers.

Give to our general KidWorks fund & Invest in Tomorrow’s Leaders

Your support matters. We’ve outlined additional ways to give below—please choose the one that works best for you.

-

Legacy Giving

Gift plans and bequests can create opportunities for you as well as for the children and youth of KidWorks. We recognize the importance of making a gift that is right for you and for your family.

Learn more

-

Crypto Donations

Donating cryptocurrency directly to KidWorks is more tax efficient and can save you money.

Learn More

-

Donating Stocks

By giving non-cash assets, such as stocks, you can give up to 20% more because of the potential to lower your capital gains tax. That’s a win-win situation for both you and KidWorks!

Learn More

-

In-Kind Donations

Throughout the year, KidWorks needs donations of school supplies, program materials, toys, and more.

Learn More

-

Corporate Giving

Partnering with KidWorks can help close the gap between community and business. More than ever, consumers are paying attention to a company’s mission and values. Aligning with KidWorks can strengthen your brand.

Learn More

-

Matching Gifts

Did you know many companies offer a matching gift program to encourage philanthropy among their employees? Learn how you can double your impact at KidWorks.

Learn More

-

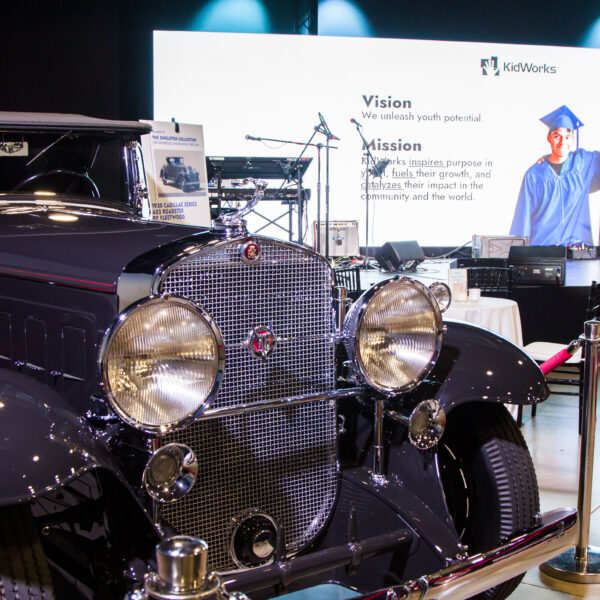

Vehicle Donation

If you have an extra vehicle that you no longer need, make the most of it by donating that car, truck, or boat to KidWorks. We’ll get top dollar for your extra car, and you can support the KidWorks Mission. Call (714) 834-9400×133 to learn more.

Learn More

-

Facebook Fundraising

If you have a birthday, a wedding or another life event coming up, why not have your friends and family celebrate with you by supporting KidWorks!

Learn More

-

Gifts of Assets*

Gifts of appreciated stocks, bonds, mutual funds and other marketable securities can provide significant tax savings as you pay no capital gains taxes and claim a deduction based on the fair market value at the time of the gift transfer.

Learn More

Monthly Giving

Join KidWorks Honor Roll, our group of dedicated monthly donors, who believe that a child’s neighborhood should not determine their access to a quality education. And now, more than ever, we rely on people like you to make it happen!

* The benefits available to you when making a charitable contribution of stock or mutual funds may include:

- Avoiding federal and state tax on the capital gain;

- Receiving an income tax deduction (federal and most states) for the full market value of the gift if you itemize deductions on your tax return and have held the assets one year or longer;

- Making a larger gift at a lower original cost to you.

IRA Rollover

Individuals who are age 70½ or older to make gifts of up to $100,000 directly from their IRA account to one or more qualified charities, without paying federal income tax on the withdrawal. Donors who wish to make a gift to benefit KidWorks Community Development Corporation, or who are fulfilling an existing pledge, may want to make a Qualified Charitable Distribution.

Here are the specifics

- Donors must be age 70½ or older at the time the gift is made

- Only traditional IRAs are eligible

- Donors must request a direct transfer of funds from their plan administrator to a qualified public charity; funds cannot be withdrawn prior to a gift or the tax benefit is nullified

- Gifts cannot be made to a private foundation or to a donor advised fund

- Gifts cannot be used to fund a gift annuity or charitable remainder trust

- Each donor may give up to $100,000 per year. For couples, each spouse can give up to $100,000

- Distributions made under this law can be used to satisfy the donor’s required minimum distribution (RMD). The rollover allows for a charitable gift to fulfill the RMD without adding to tax liability

To make a gift to KidWorks from an IRA, contact your IRA plan administrator and request a direct Qualified Charitable Distribution from the IRA account to KidWorks Community Development Corporation, a 501(c)(3) organization, with Tax ID number 74-3081569. Checks should be mailed directly to KidWorks Community Development Corporation, 1902 W Chestnut Ave, Santa Ana, CA 92703

KIDWORKS DONORS

We cherish the opportunity to remember and celebrate our faithful supporters and donors. Please visit our donors page for the most up-to-date listing of KidWorks supporters.

We are committed to excellence and accountability in order to achieve measurable results that demonstrate our positive impact in the neighborhoods we serve.

Note: KidWorks Community Development Corporation cannot give tax or legal advice. Please consult your own professional tax advisor about the best way to take advantage of any giving opportunity.